International schemes

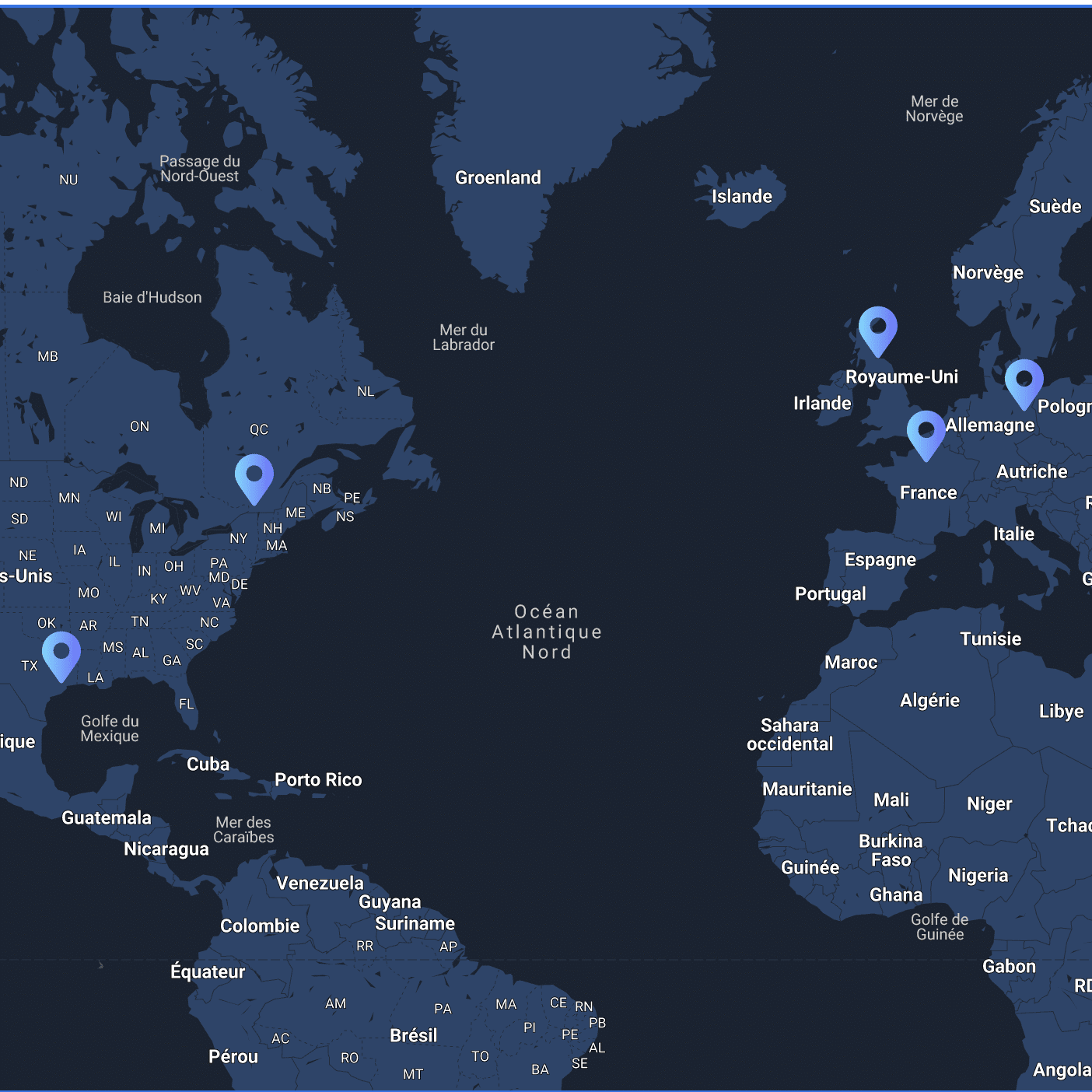

The challenges of innovating are international. When initiating a new project, your researchers develop a global state-of-the-art. You’ll be wondering about the most appropriate geographical area to open a new research centre or build a pilot plant. ABGi helps large groups and SMEs to activate and optimise their national systems, with offices and a network in Europe and America.

national systems, in compliance with legislation and regulations.